A revolving business line of credit is a flexible financing option that allows small businesses to access funds as needed. Unlike a traditional business loan, where you receive a lump sum upfront, a revolving line of credit allows you to draw cash as you need it and only pay interest on the amount you borrow. It functions similarly to a personal credit card, giving you the freedom to borrow and repay funds multiple times within a set credit limit.

How Does a Revolving Business Line of Credit Work?

A revolving business line of credit works by providing you with a credit line that you can borrow from as needed. The key difference between a revolving line of credit and a regular business line of credit is that with a revolving line, you have the ability to access additional funding after paying down the balance.

Here’s how it works:

-

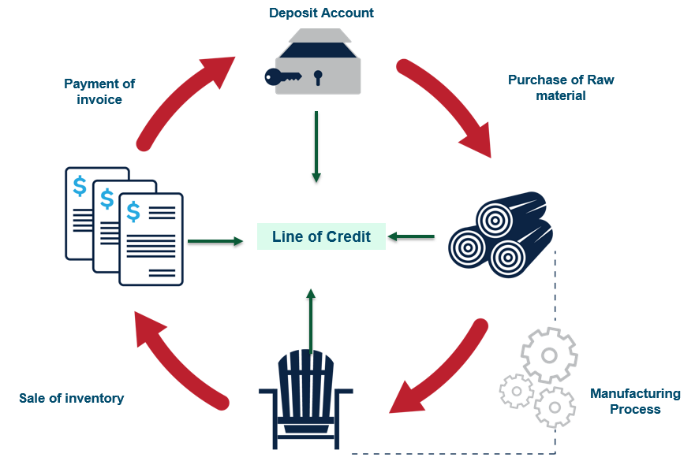

Credit Line: You are given a credit line from which you can borrow up to a certain maximum. This credit line is linked to your account electronically, providing you with immediate access to funds 24/7.

-

Borrowing: Similar to a personal credit card, you can borrow funds from your credit line as needed. You have the flexibility to borrow only the amount you require at any given time, whether it’s for purchasing inventory, covering operating expenses, or investing in business growth initiatives.

-

Repayment: After you borrow funds from your credit line, you are required to repay the amount borrowed, along with any interest incurred. You have the option to repay the entire balance or make minimum monthly payments, depending on the terms of your agreement.

-

Revolving: Once you repay the borrowed amount, those funds become available to you again. This means you can redraw the same funds, giving you ongoing access to working capital. This revolving cycle of borrowing and repaying is where the term “revolving” comes from.

Pros and Cons of a Revolving Business Line of Credit

Like any financing option, revolving lines of credit come with their own set of advantages and disadvantages. Understanding the pros and cons can help you determine if a revolving line of credit is the right choice for your business.

Pros

-

Draw funds as-needed: With a revolving line of credit, you can borrow funds as needed, giving you the flexibility to address immediate business needs.

-

Interest only on what you draw: Unlike a traditional loan, where you pay interest on the entire amount borrowed, a revolving line of credit allows you to pay interest only on the funds you actually use.

-

Flexible use of funds: You have the freedom to use the funds for any business purpose, whether it’s purchasing inventory, covering operating expenses, or investing in growth initiatives.

-

Opportunity to build business credit: By responsibly borrowing and repaying funds, you can improve your business’s creditworthiness and establish a positive credit history.

Cons

-

Difficult to qualify without collateral: Revolving lines of credit can be more challenging to qualify for without collateral. Lenders may require some form of security to mitigate their risk.

-

Higher interest rates: Compared to traditional loans, revolving lines of credit often come with higher interest rates due to the flexibility and convenience they offer.

-

Lower funding amounts: Depending on your business’s creditworthiness and financial situation, the maximum credit limit of a revolving line of credit may be lower than other types of financing.

-

Potential for fees and contingencies: Some revolving lines of credit may have additional fees, such as annual fees or maintenance fees. It’s important to carefully review the terms and conditions of the credit line to understand any potential costs.

How to Use a Revolving Business Line of Credit

A revolving business line of credit provides business owners with quick and easy access to funds. The flexibility of this financing option allows you to address various business needs as they arise. Here are some common ways you can use a revolving line of credit:

-

Working capital: Use the funds from your revolving line of credit to cover everyday operating expenses, such as payroll, rent, utilities, and inventory purchases.

-

Inventory management: If your business relies on inventory, a revolving line of credit can help you manage inventory levels and take advantage of bulk purchasing opportunities.

-

Business expansion: Whether you’re looking to open a new location, renovate your existing space, or invest in equipment, a revolving line of credit can provide the necessary funds to support your growth initiatives.

-

Cash flow management: Use your revolving line of credit to bridge cash flow gaps during seasonal fluctuations or when waiting for customer payments.

-

Emergency expenses: In the event of unexpected expenses, such as equipment breakdowns or repairs, a revolving line of credit can provide the necessary funds to address these emergencies quickly.

Ultimately, the best way to use a revolving business line of credit will depend on your specific business needs and goals. It’s essential to have a clear plan in place and use the funds responsibly to maximize the benefits of this financing option.

Types of Businesses That Can Benefit from a Revolving Business Line of Credit

Revolving lines of credit are a versatile financing option suitable for various industries and business types. Here are a few examples of businesses that can benefit from a revolving line of credit:

-

Construction: Cover upfront costs for materials, equipment, and operating expenses without impacting your cash flow.

-

Hospitality: Use a revolving line of credit to fund renovations, repairs, expansions, or other improvements to keep your business running smoothly.

-

eCommerce: Leverage a revolving line of credit to purchase bulk inventory, upgrade your online presence, or increase your purchasing power to qualify for supplier discounts.

-

Manufacturing/Wholesale: Grow your manufacturing or wholesale business by purchasing materials in bulk, strengthening your team, and investing in automation.

These are just a few examples, and businesses in various industries can benefit from the flexibility and accessibility of a revolving line of credit.

Grow Your Credit as You Grow Your Business

One of the notable advantages of utilizing a revolving business line of credit is the opportunity to build your business credit as you borrow and repay funds. By responsibly managing your credit line, you can improve your business’s creditworthiness and open doors to additional financing opportunities in the future.

Unlike traditional loans, which may require extensive financial histories or minimum credit scores, revolving lines of credit offer a more inclusive approach to credit. This means that even if you don’t have a long credit history or a perfect credit score, you still have a chance to qualify for a revolving line of credit.

It’s important to note that not all lenders offer true revolving lines of credit. Some may advertise revolving terms but provide regular business loans or lines of credit without the revolving feature. To ensure you’re getting a true revolving business line of credit, it’s crucial to carefully review the terms and benefits offered by different lenders.

How Long Does it Take to Get a Revolving Business Line of Credit?

One of the advantages of a revolving business line of credit is the relatively fast funding process. While traditional loans can take weeks or even months to process, revolving lines of credit typically have a quicker turnaround time.

In many cases, the funding process for a revolving line of credit can be completed within 24 hours of application submission. In some instances, it can even be as short as a few hours. This expedited funding process is possible because revolving lines of credit don’t require collateral or a minimum credit score, making them more accessible to small business owners.

To expedite the funding process, it’s important to have all the necessary documentation prepared and provide accurate and complete information on your application. This will help lenders assess your business’s eligibility and process your application more efficiently.

Flexible Financing to Help You Through 2023 & Beyond

As the ongoing pandemic continues to impact businesses worldwide, having access to flexible financing is more critical than ever. Uncertainty surrounding credit tightening and the possibility of a recession has made it imperative for entrepreneurs to explore financing options that offer flexibility and adaptability.

A revolving line of credit can provide the financial stability and freedom needed to navigate through challenging times and invest in business growth. With extra cash on hand, you can cover payroll, operating expenses, and other costs that may arise, ensuring that your business can operate at its highest capacity.

Furthermore, a revolving line of credit allows you to invest in new income streams that can boost sales during economic downturns and position your business ahead of competitors. By seizing opportunities and strategically managing your cash flow, you can set your business on a path to success both during and after challenging times.

Business Line of Credit Qualifications

Qualifying for a revolving business line of credit is typically more accessible compared to other types of financing. While specific requirements may vary depending on the lender, there are common qualifications that most lenders consider:

-

Minimum annual gross sales: Lenders typically require businesses to have a minimum annual gross sales threshold, often around $120,000 or more.

-

Business tenure: Most lenders prefer businesses that have been operating for at least six months or more, demonstrating stability and a track record of revenue generation.

-

Vision for success: Lenders want to see that you have a clear vision for your business’s success and a plan for utilizing the funds from the revolving line of credit.

Unlike traditional loans, revolving lines of credit don’t require real estate collateral, minimum FICO scores, or extensive financial histories. This makes them a viable financing option for a wide range of businesses, including startups and those with limited credit histories.

Conclusion

A revolving business line of credit offers small businesses a flexible and accessible financing option to address immediate funding needs. With the ability to draw funds as needed and repay them over time, revolving lines of credit provide businesses with the working capital necessary to cover operating expenses, invest in growth initiatives, and manage cash flow effectively.

While there are pros and cons to consider, revolving lines of credit can be a valuable tool for businesses in various industries. By understanding how they work, exploring different use cases, and qualifying for the credit, entrepreneurs can leverage the benefits of revolving lines of credit to support their business’s growth and navigate challenging economic conditions.

As you consider financing options for your business, a revolving line of credit can provide the financial flexibility and stability you need to thrive in today’s dynamic business landscape. Take the time to research different lenders, compare terms and benefits, and choose the option that aligns best with your business goals and needs.